As the "upgraded version" of Pix—Brazil’s most popular payment method — Pix Automático ,launched by the Central Bank of Brazil in June is igniting the market.

For SaaS and AI software companies expanding globally, this presents a golden opportunity to tap into Latin America’s largest economy.

However, Connecting Pix Automático comes with challenges:

Most providers only support recurring payments at the API level, requiring merchants to independently develop subscription management, marketing, and data analytics modules.

Rushed integration with inefficient providers often leads to conflicts in subscription flexibility/payment timing, resulting in high trial-and-error costs.

If these issues with you, this guide has your solution.

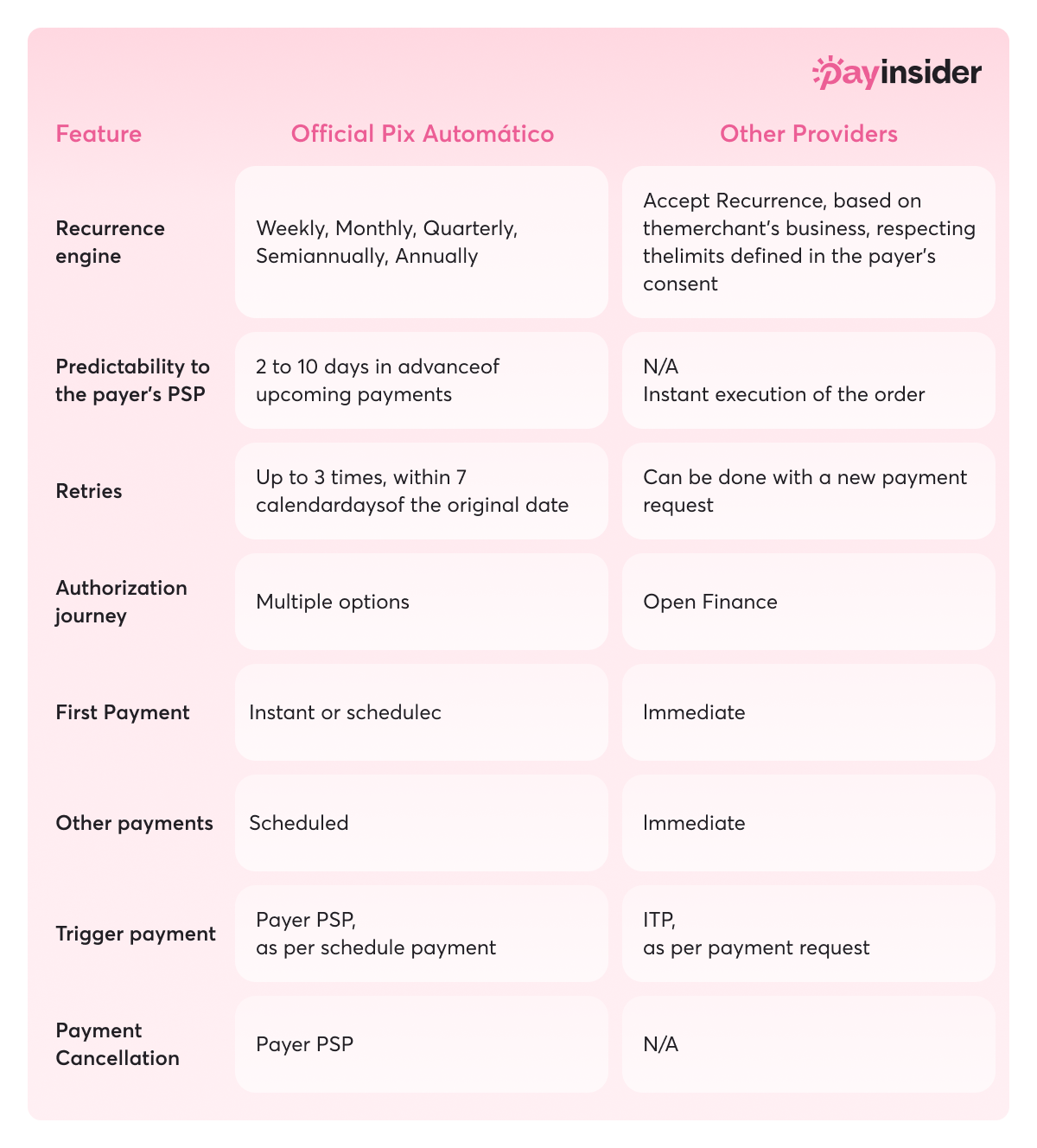

What is Pix Automático?

Pix, Brazil’s instant payment system (used by 91% of adults), now has a game-changing upgrade: Pix Automático (launched June 2025). It enables automated recurring payments via API,supporting:

Subscription creation & real-time payment confirmation

Retry logic, cancellations, and refunds.

Users authorize a one-time bank approval, after which payments are automatically deducted monthly/quarterly/annually.

Backed by the central bank and unmatched user coverage, it outperforms credit cards and digital wallets in retention and payment success rates.

Projected to reduce payment failures by 30%, it’s set to unlock massive potential for streaming, SaaS, and subscription businesses—connecting you to 60M+ incremental users.

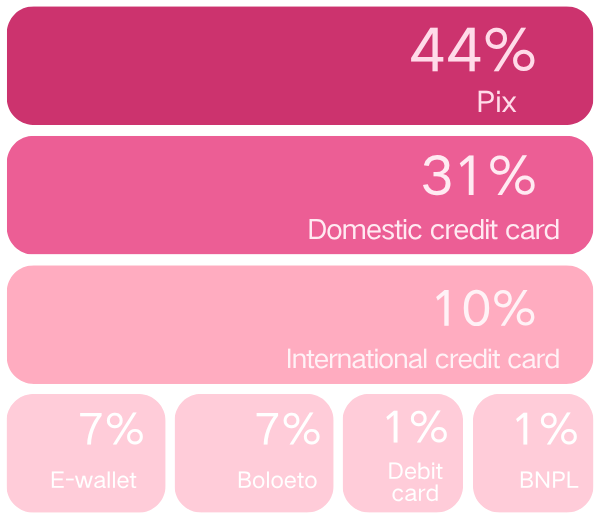

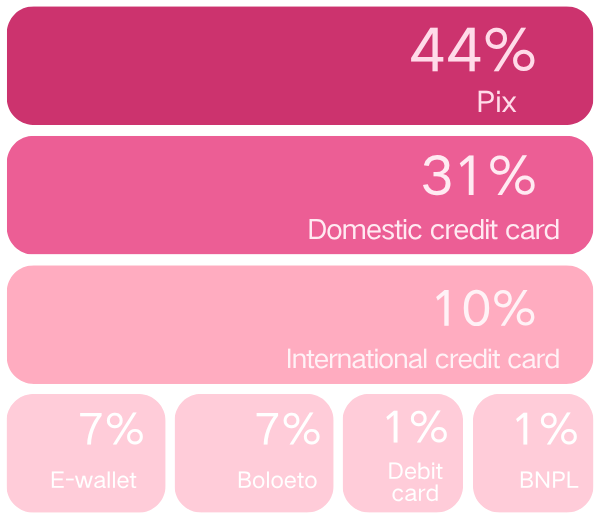

Payment Method Distribution in Brazil

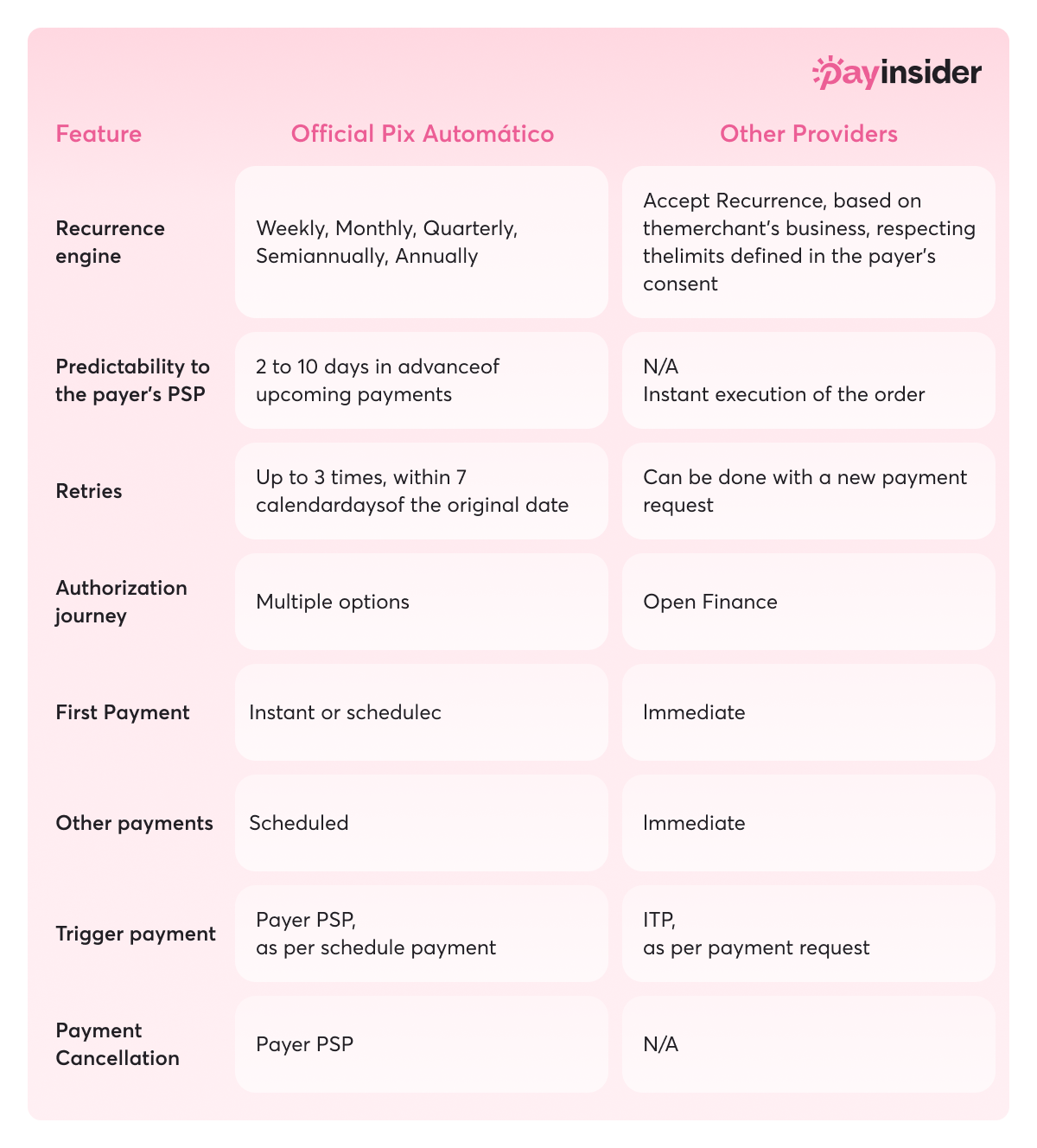

Currently, many payment service providers have integrated with the official Pix Automático system. As a payment platform, Payinsider has identified through product research and technical collaborations that different providers have implemented varying product optimizations for Pix Automático - particularly in subscription management flexibility (including support for customized billing cycles and real-time billing cycle modifications).

1. Do You Need a Local Brazil Entity?

While many providers support Pix Automático, some mandate a Brazilian legal entity, whereas others enable cross-border access.

Requirements and onboarding timelines vary drastically—making upfront research critical for non-local companies.

2. Subscription Flexibility Matters

Moreover, while integrating Pix Automático, global businesses must also deploy a complete subscription management system – encompassing billing, marketing, and revenue analytics. Developing this in-house demands significant time and technical resources, with ongoing maintenance further diverting funds from core priorities like product development and market expansion.

Recognizing these challenges, Payinsider offers a ready-to-deploy subscription and billing solution with official partnerships across Latin America's top payment providers. Our codeless integration embeds directly into your platform, eliminating years of development work. Enter Brazil faster, at lower cost – and start growing revenue immediately.

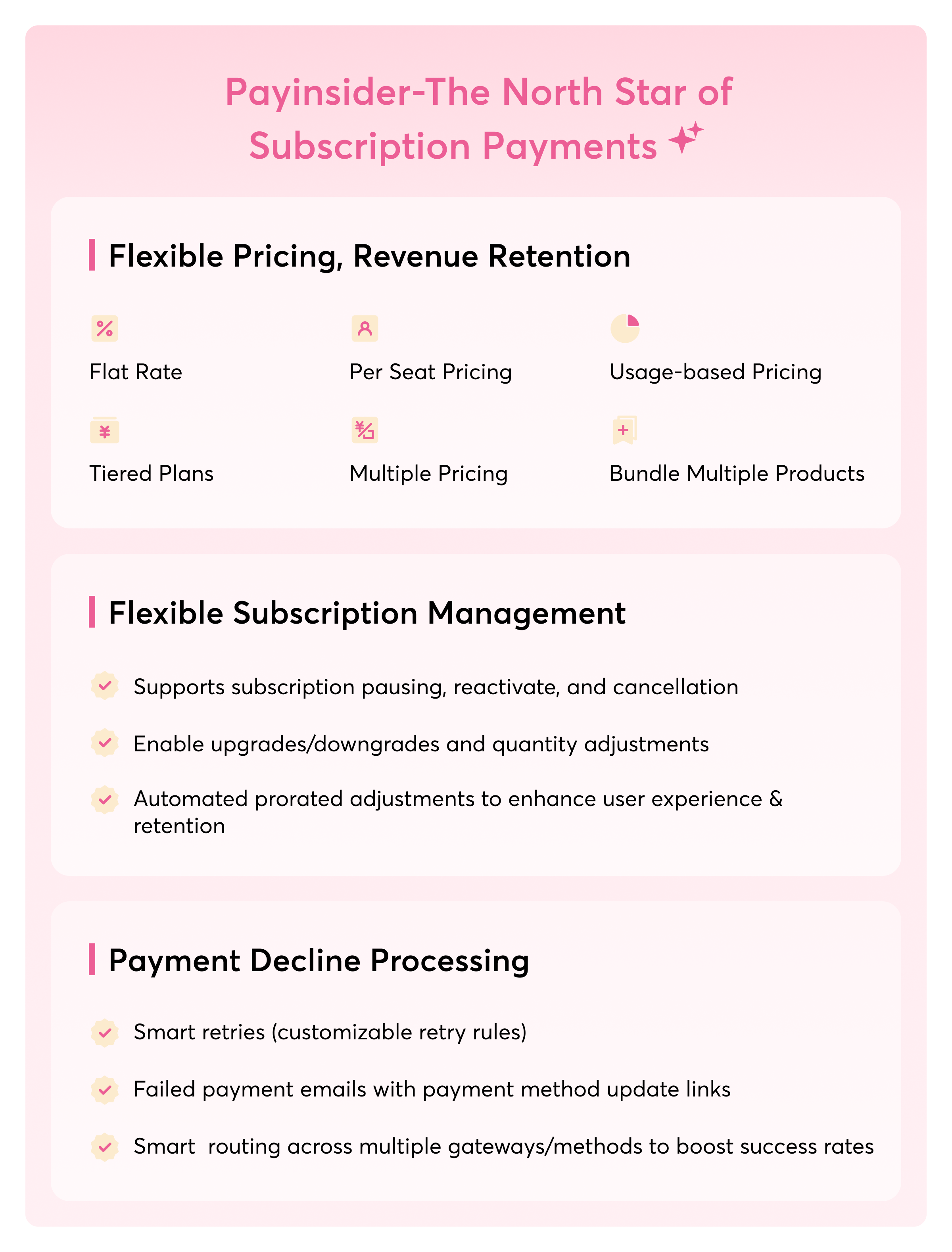

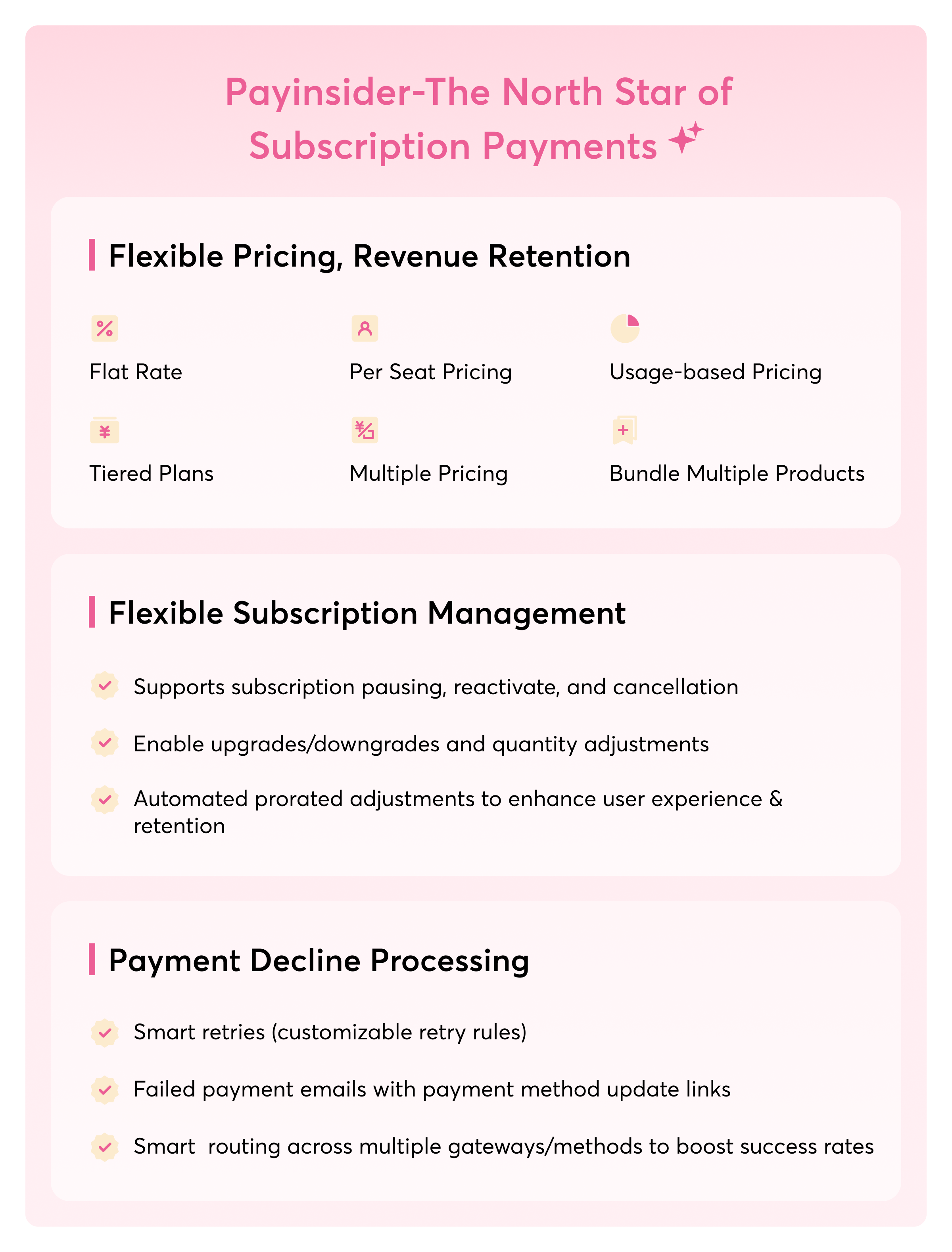

Payinsider: Plug-and-Play Subscription Management

For subscription-based AI and SaaS businesses, designing flexible pricing models is key to monetization, while involuntary churn critically impacts revenue stability.

Payinsider delivers flexible subscription billing with customizable plans, paired with an efficient management module to effortlessly control service cycles and payments. Our solution reduces involuntary churn by 50%+, ensuring stable, sustainable revenue growth.

Lock in Every Brazilian Revenue Stream

Payinsider, as a Payment orchestration platform built for subscription business, has deeply integrated with top-tier Brazil local and futher global payment providers to deliver configurable solutions—eliminating costly trial and error. Beyond optimizing your payment flows, we enable 100% coverage including:Credit cards,Boleto,Pix,Local e-wallets.