Executive summary

Global SaaS growth increasingly depends on how “local” your product feels at the moment of purchase. Leaders like Canva and Adobe show that offering local prices in native currencies and the right payment methods for each market can unlock double-digit uplifts in conversion, revenue, and long-term growth. Digital wallets and account-to-account (A2A) rails are now mainstream in many regions, while local card acquiring and strong checkout optimization raise authorization rates and reduce costs. The data is unambiguous: localization at checkout is not a feature—it’s your global growth engine.

What Leaders Do: Canva and Adobe as Practical Playbooks

Global B2C leaders operationalize localization with discipline. Canva maps payment preferences country-by-country and supports local methods directly in its checkout:

Canva’s supported payment options page is a living proof-point for “local by default” method

These are not “nice to have” options; they are the default ways many customers pay, and Canva meets them there to remove friction and raise trust Canva. Adobe goes equally deep on price localization by charging in local currencies for a large roster of countries—from, from BRL in Brazil to INR in India and KRW in South Korea—reducing FX surprises and aligning price points with local purchasing power. Their “Currencies supported by country” matrix shows how systematically Adobe implements currency and purchasing localization at scale for teams and enterprise.

Customer Demand Has Shifted: Wallets, A2A, and Mobile-First Checkouts

Digital wallets now dominate many online journeys. In 2023, wallets accounted for $13.9 trillion in global transaction value, representing 50% of e-commerce spend and 30% at point of sale; by 2027 they’re projected to exceed $25 trillion and 49% of all sales online and at POS combined. This is not a niche—it is the median global behavior. Mobile’s share of global e-commerce has also tripled over the decade, from 19% to 57%, making mobile-native wallet flows (Apple Pay, Google Pay, local wallets) a conversion-critical standard.

Meanwhile, account-to-account (A2A) rails are transforming key markets. Brazil’s Pix drove A2A e-commerce spend from $3.6 billion in 2020 to $35.3 billion in 2024, changing how consumers expect to pay at checkout.

Global A2A e-commerce is projected to reach $936 billion by 2030—especially relevant for subscriptions and invoices in cost-sensitive segments that benefit from low fees and instant settlement.

1. What Localization Does to Outcomes: the Evidence

Controlled experiments and at-scale analyses consistently show large gains when businesses match price and payment to local norms. Payinsider’s statistically significant holdback experiment across 50+ payment methods found that dynamically surfacing at least one relevant method beyond cards lifted conversion by 7.4% and revenue by 12% on average.

In specific market-method pairings, the effects were dramatic: +46% with BLIK in Poland, +39% with iDEAL in the Netherlands, +27% with Konbini for digital apps in Japan, and +47% with PayPal for digital media in Germany. Even globally, Apple Pay increased conversion by 22.3% and revenue by 22.5%. Bank debits also matter by use case: SEPA Direct Debit raised conversion 12% in the EU, and ACH/Bacs can drive net-new volume rather than cannibalizing cards

stripe.com.

Vendor-side SaaS growth analyses reinforce the compounding effect of price and payment localization. Paddle reports that companies with multi-currency enabled grew 7% faster than those without; offering two currencies grew 13% faster than one; and offering 25+ currencies correlated with 25% higher growth. In 2021, companies with at least one alternative payment method grew 22% faster than those without, and ProfitWell data shows businesses with four or more truly localized regions doubled their average month-over-month growth versus no localization. While vendor studies should be interpreted alongside your telemetry, the directional signal is strong and consistent with what we see in platform-scale experiments

Paddle.

2. Local Acquiring: Essential Plumbing for Higher Authorization and Lower Cost

Payment performance is not only about what methods you show; it’s also about how you route and acquire them.

Local acquiring—processing via an acquirer domiciled in the buyer’s country—improves issuer familiarity, reduces cross-border fees, and helps charge in the customer’s native currency. The net effect is higher authorization rates and lower total cost of acceptance, with faster settlements and fewer surprises for customers (no foreign transaction fees on statements). For global SaaS, local acquiring provides a base layer that makes your localization look and feel “native,” while your orchestration layer decides when to switch between acquirers for reliability and cost.

3. Regional Snapshots: How Local Varies by Market

Europe

EuropeDigital wallets are now the leading online method in nine of the 14 European markets tracked by Worldpay’s Global Payments Report, and many consumers fund wallets via bank accounts—an important hint for promoting A2A options in the right contexts. Local cards and SEPA Direct Debit remain core for subscriptions, while SCA and 3DS user experience can make or break mobile conversion. Translating checkout UI and respecting address/date formats pays immediate dividends in trust and completion.

Asia-Pacific

Asia-PacificAPAC has long been a digital payments pace-setter, with wallets the leading online method in eight of 14 APAC markets covered by Worldpay. Country specifics matter: Japan’s Konbini works for digital goods, India’s UPI dominates everyday payments, and Southeast Asian e-wallets often tie tightly to super-app ecosystems. Stripe notes cross-border revenue in Asia grew >30% in 2023 among its users, reflecting both demand and readiness to buy if payment frictions are removed.

Brazil (LATAM)

Brazil (LATAM)Pix has transformed checkout behavior. Since its launch, A2A e-commerce spend rose from $3.6 billion in 2020 to $35.3 billion in 2024. For subscriptions and invoices, Pix can cut fees, boost confirmation speed, and reduce involuntary churn if combined with smart reminders and instant retry logic. Merchants expanding in LATAM should treat Pix, boleto, and local cards as baseline, not “alternative,” methods.

India

IndiaUPI has revolutionized daily payments, compressing cash share and dominating e-commerce transaction value, with third-party sources citing UPI at 64% of e-commerce value and 58% at point-of-sale by 2024. For SaaS with low AOVs and mobile-first acquisition, UPI handles can reduce friction versus cards while preserving trust and speed; however, recurring mandates have their own rules that require product and ops alignment.

4. The Pricing Half of Localization: Evidence and Approaches

Local pricing is not just currency conversion. It’s aligning list price, psychological price points, and tax-inclusive displays with local expectations and purchasing power.

Adobe’s country-currency matrix is a concrete indicator of how deep global leaders go to reduce FX shock and increase perceived fairness. Paddle’s SaaS growth analysis suggests multi-currency and price localization meaningfully correlate with faster growth; even adding a single extra currency confers a measurable advantage, and expanding to 25+ currencies compounds this effect.

For fast-growing AI software companies, core resources must be focused on product development and market expansion. While building a payment system is a top priority in the "from zero to one" phase, optimizing it often gets deprioritized during scaling. Global and local adaptation—particularly in payments and pricing—tends to fall into the “important but not urgent” category.

This is precisely why leveraging a specialized payment platform becomes critical. It not only reduces technical investment by over 80% but also provides data-driven models and industry expertise to support smarter decision-making in selecting payment methods and partners—much, much like a test-taker who already knows the answers, helping you avoid pitfalls and accelerate growth.

What a Payment Orchestration Platform Should Operationalize

Method Localization

Method LocalizationSurface only the two or three top methods for each user’s locale and device. Stripe’s experiment shows “relevant method + dynamic surfacing” beats “everything everywhere,” yielding +7.4% conversion and +12% revenue on average across the portfolio. Use geolocation, BIN, device and basket signals to decide in real time

stripe.com.

Local Acquiring and Smart Routing

Local Acquiring and Smart RoutingRoute to onshore acquirers where possible to raise approvals and lower cross-border fees; fall back to cross-border routes for resilience; and test issuer-optimized strategies (network tokens, retriable soft-declines, 3DS challenge logic). Expect acceptance uplifts in the 1–3% range to be achievable with disciplined iteration.

Mobile-first Wallet Flows

Mobile-first Wallet FlowsPrioritize Apple Pay/Google Pay and prominent local wallets on small screens. Stripe reports Apple Pay raised conversion 22.3% and revenue 22.5% on average in eligible checkouts; in some UIs, early placement of Apple Pay doubled conversion relative to end-of-flow placement.

Price and Currency Strategy

Price and Currency StrategyShow prices in local currency end-to-end, avoid mid-flow currency switches, and include taxes where customary. Monitor upgrade propensity and refunds by currency; local psychological pricing (e.g., 99 models or culturally preferred roundings) can nudge acceptance without discounting.

A2A (Account to Account) Readiness

A2A (Account to Account) ReadinessWhere A2A is mainstream (Pix, UPI, SEPA SCT Inst), design confirmation UX and billing operations to match its strengths: instant confirmation, low fees, and clear reconciliation. For subscriptions, ensure mandate handling and reminders fit local norms and regulators.

Compliance as UX

Compliance as UXBuild Strong Customer Authentication (SCA), 3DS, and OTP into a cohesive UI that doesn’t feel like a redirect. Friction is inevitable; the lost conversion is not, if flows are embedded and device-tested. Make compliance features local in language and formatting.

Involuntary Churn Control

Involuntary Churn ControlPayment failures can silently drain subscriptions. While benchmarks vary, optimized dunning and intelligent retries consistently recover meaningful revenue; Checkout.com’s TEI composite saw 7% fewer retries and material cost savings from smarter recovery. Combine network tokens, card updater services, and localized reminders to minimize involuntary churn.

Case Study Snapshots: Translating Playbooks into SaaS Wins

Canva: A Truly Local Checkout

By supporting iDEAL (NL), Sofort (DE), GCash (PH), GoPay (ID), Pix (BR), KR local cards with Kakao Pay and Naver Pay (KR), and MoMo (VN) alongside cards and PayPal, Canva narrows the cultural and technical distance between global products and local buyers. In markets where bank transfers or e-wallets anchor daily life, “cards-only” feels foreign; Canva’s support list reads like a map of trust, which is exactly why it converts

www.canva.com.

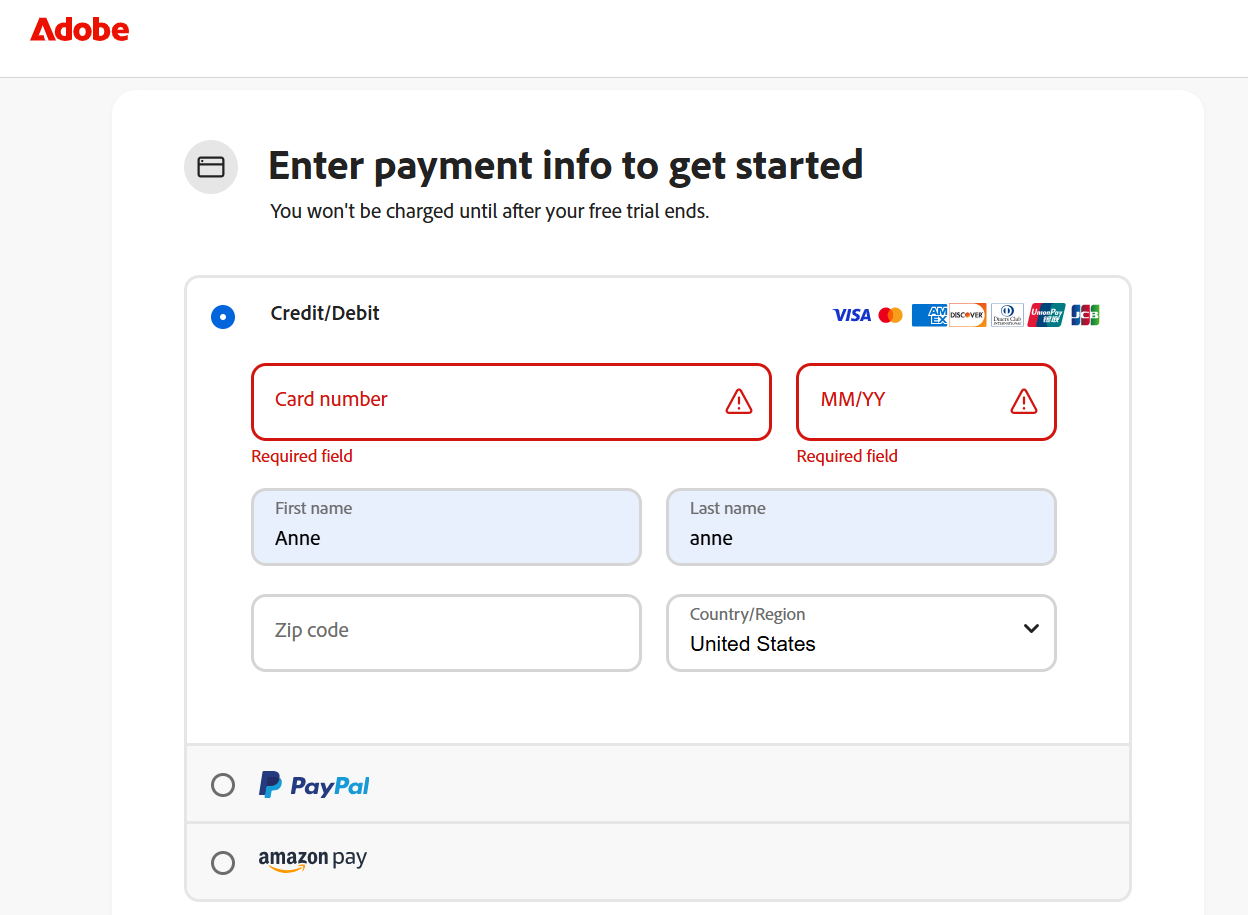

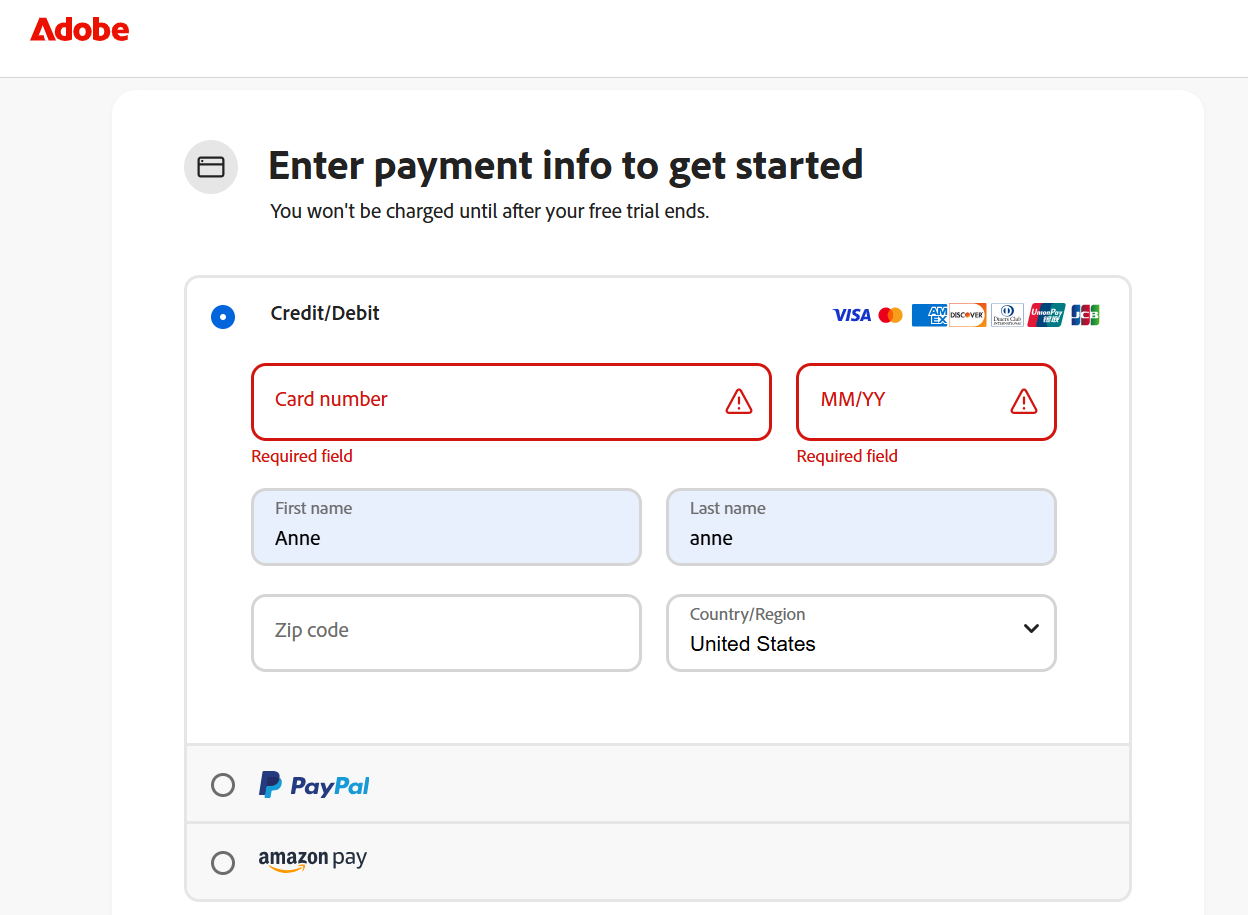

Adobe: Currency Fit as Conversion Strategy

Adobe’s currency-by-country coverage is a case study in reducing FX friction and aligning value presentation with local purchasing power. When list price, currency, and taxes appear native, trial-to-paid conversion and retention both benefit because customers perceive the relationship—and the commitment—as domestic rather than foreign. For enterprise buyers, this humility in pricing mechanics often shortens procurement cycles too

helpx.adobe.com.

Netflix: Recurring UPI Autopay and Localized Payment Acceptance

Netflix supports UPI for payments in India and explicitly enables UPI AutoPay mandates for recurring billing. Members can switch existing accounts to UPI AutoPay via their Billing details, demonstrating deep integration with local mandate rules.

Recurring mandates on local rails are crucial for subscription continuity and minimizing involuntary churn; Netflix aligns billing mechanics with local infrastructure.

How to Systematically Implement Global Pricing and Payment Strategies for the Next 90 Days

Before formally considering whether to adopt localized pricing and payment strategies, you can start by asking the following three questions based on existing market data:

- Where does your website traffic come from? Where do users drop off?

- Are there certain countries/regions showing high engagement but low conversion rates?

- Are there specific regions generating customer support tickets complaining about payment failures?

If two or more of these questions resonate with your situation, the five-step localization strategy summarized by Payinsider from practical experience may help you implement your localization efforts in a more structured manner:

Step 1: Understand Your Baseline Reality and Set Growth Goals

For your top five non-English markets, measure the current usage share of payment methods, credit card authorization rates by BIN country, and checkout drop-off points on mobile devices. This will provide clear targets for localization impact and help plan which wallets or A2A (Account-to-Account) payment methods to enable in which regions.

Step 2: Enable Local Currency

- Product catalog, shopping cart, and pricing in local currency

- Eliminate currency changes during the checkout process

- Adapt pricing psychology to market preferences (leveraging Payinsider’s proprietary global pricing data model—contact us for details)

- In some regions, displaying prices inclusive of taxes is customary (e.g., EU, India, Brazil)

- Add data tracking points to monitor and analyze growth in add-to-cart and payment page submissions

Step 3: Add at Least Two Essential Payment Methods per Market

Based on usage patterns and basket types, integrate the top two payment methods (e.g., iDEAL/PayPal in the Netherlands; Pix/cards in Brazil; UPI/e-wallets in India). Conduct A/B tests comparing "dynamically recommended payment methods" with "credit card-only" options. If your transaction volume is sufficient, expect a double-digit percentage improvement in conversion rates.

Step 4: Implement Local Acquiring Channels

Prioritize connecting to local acquiring networks in core markets and compare authorization rates for domestic versus cross-border routing. Aim for a 5–10% increase in transaction acceptance rates; use smart rerouting for soft-declined transactions.

Step 5: Pilot A2A Payments in Key Markets

Launch pilot programs in markets with mature instant payment infrastructure (e.g., Pix/UPI/SEPA Instant). Design user experiences that support instant payments and refund confirmations. Compared to long-tail credit card users, this approach typically reduces payment costs and enhances user trust (B2B businesses can simultaneously adjust financial reconciliation and collection processes for even greater effectiveness).

The Key Role of Payment Orchestration Platforms in Globalization

Dynamically Display Local Payment Methods to Increase Checkout Conversion Rates by 7.4% Only two or three preferred payment methods tailored to the user’s region and device are displayed. Experiments by Payinsider show that "relevant payment methods + dynamic display" outperform "comprehensive display," resulting in an average conversion rate increase of 7.4% and a revenue increase of 12% across the business portfolio.Leverage real-time signals such as geolocation, BIN, device, and shopping cart data to make decisions.

Smart Routing and Local Acquiring to Increase Authorization Rates by 7–10% Route transactions to domestic acquirers whenever possible to improve approval rates and reduce cross-border fees;

Fall back to cross-border routing when necessary to ensure resilience; and test issuer optimization strategies (network tokenization, retryable soft declines, 3DS challenge logic). Through disciplined iteration, an authorization rate increase of 7% to 10% can be expected.

Localized Pricing Strategies to Enhance Purchase Wilingness Display prices in the local currency throughout the shopping cart, avoid currency switches during transactions, and automatically include taxes based on local practices. Monitor upgrade tendencies and refunds by currency;Payinsider recommends localized psychological pricing strategies (e.g., charm pricing like 99 endings or culturally preferred rounding) based on its proprietary database and models, which can boost acceptance without discounts.

Data Dashboards and A/B Testing to Support Continuous Optimization Whether it’s A/B testing for localized pricing or adding new payment methods, data fluctuations provide direct insights and reasons for outcomes.

Smart Retry Mechanisms to Reduce Involuntary Churn Payment failures can silently erode subscriptions. While benchmarks vary, smart retries consistently recover significant revenue; more intelligent recovery measures lead to notable cost savings.

Closing Thought for Payment Orchestration Platforms

Globalization for SaaS is now a craft: orchestrating local price, currency, method, and acquiring decisions into a checkout that feels native anywhere. Leaders don’t guess—they measure method relevance, route locally, and operationalize compliance as UX. The data shows you can buy back double-digit conversion and revenue with these moves. For orchestration platforms, the opportunity is to turn these patterns into defaults: dynamic method surfacing, market-aware pricing, local acquiring by design, and intelligent recovery, all backed by transparent KPIs and rapid experimentation. Ship those, and your merchants will feel like locals wherever they sell.